Brendan

Harrison's Down to Earth landscaping company

had to stop planting in St.

Louis this summer.

But he’d already hired workers for the season back in spring. How could he know

he’d face the most extreme drought in at

least a generation?

|

| USDA's running tab of states and counties experiencing drought conditions. |

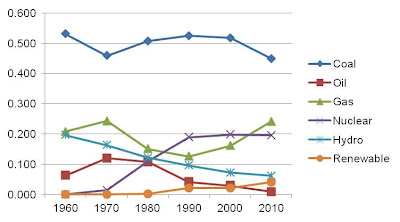

At the most basic level, risks

can be systematic or unsystematic. A systematic risk applies to a broad

category of assets. Seems like a good description of climate change. For

example, if temperatures are rising globally (a hazard risk), all of our

facilities may be at risk of higher costs for air conditioning or cooling (a

financial risk). Or if I am in the agricultural industry, all of my crops, in all

locations may suffer productivity losses. Risk managers remind us that systematic

risks are hardest to manage mostly because they can’t be avoided by diversification.

|

| Complexities of climate change. Source: IPCC 2007 |

As an example of an unsystematic risk, consider the last

item in that list, disease patterns. Higher temperatures can dry out some areas

like the drought in over half the US; but makes others more humid, particularly

areas near water bodies. And the increased humidity can help microbes that infect

humans. The effect is local and is limited to certain times of the year, such

as the hottest part of summer. That is an unsystematic risk.

If my company happens to have a factory nearby and my

workers live in areas exposed to those microbes then it’s a risk for me. So

climate change can create systematic risk that is hard to manage corporate wide,

and unsystematic risk that may be off the radar screen of headquarters but can

wreak havoc on the whole supply chain if my plant is a bottleneck and employees

call in sick for an extended period (an operational risk).

These risks are widely

appreciated in the financial community. For example, the

Financial Times reports that two-thirds of asset managers consider climate

risks in portfolio management. This proportion is likely to grow. Just this

June, the British Government announced that firms listed on the Main Market of

the London Stock Exchange would be required

to report their greenhouse gas emissions.

The reasoning is that those emissions constitute a policy

risk if they are subject to nationally or internationally imposed limits. Is it

a systematic risk? It will be hard for individual corporations to address that

risk since most of the emissions are inherent in the energy production system

of the nation, and the world.

But it is possible. For example, many IT companies that

are so dependent on huge energy supplies have diversified

their energy sources away from fossil fuels towards wind, solar, hydro, and other

renewable sources. Just switching from coal to natural gas can cut your

greenhouse gas emissions in half. This would constitute a strategic risk

for the coal company. So IT companies face a risk that, on the surface appears

systematic but when approached imaginatively may turn out to be not so

systematic, and become a differentiator among companies.

It may also become a differentiator among business leaders.

Those who fail to deal with these risks will no longer be deemed prudent. Brendan Harrison may plan

differently next year.